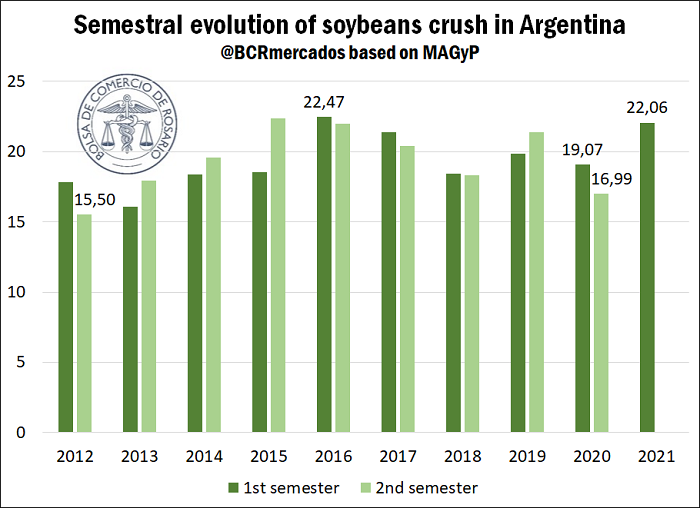

After low processing, soybean crush recovers in the second semester of 2020

During the second semester of 2020, soybean crush suffered an important decrease due to several factors (union conflicts that affected the operation of ports and a still relevant impact of the pandemics over the economy), arriving at a processing of only 16.99 Mt. This value was far behind the one reached the previous year, and on minimum values since year 2012.

In this sense, 2021 started with soybeans stocks far above the usual, with 8.4 Mt in the month of January. That is to say, 65% above the same month during the previous year and 12% above the average of the last five years.

In this scenario of high stocks and external commitments to be fulfilled by a large part of the industries, a high volume of soybean started to be processed in all the port terminals of Rosario city cluster, mainly. This way, during the first semester of 2021, a crushing of 22.06 Mt was reached, which represents a maximum value since year 2016.

If we focus on the first months of season 2020/21, between April and June, the crop season started with good margins according to our own forecasts based on the theoretical FAS estimation of US$ 16/t between April and May, at US$ 1.39/t by the end of June. In the sense, this theoretical margin has been progressively reduced, while local prices of soybean peaked and then gained stability.

During the first three months of the crop season, unprocessed soybean shippings represented less than 16% of the exports of soy complex, with the rest of shippings being made up of oil, meal and biodiesel.

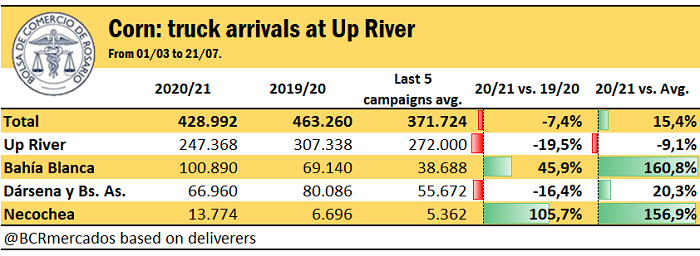

Low river water level and harvest delay: less corn in the Up River Paraná Ports

Corn harvest 2020/21 progressed to 77% of the total planted, according to the last available data by the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym). This number is almost 15 percentage points behind the progress made during last crop season, when 92% of the parcels with corn had been harvested by this time of the year.

It is worth pointing out, also, that the territory with the most harvest delays is Córdoba, the leading province in production, that will supply more than 40% of Argentinian corn during crop season 2020/21. Harvesters in Córdoba have completed, to date, 72% of the parcels, still far from the 98% achieved by the same date last year.

Santa Fe, another important origin of corn in the central region of Argentina, has completed 89% of its harvest, barely behind the percentage achieved during last crop (92%). On its part, Buenos Aires, which assigns part of its production to the river ports in the North of the province and another part to the sea ports in the South, has completed 88% of its planted area, improving last year’s pace. At the same time, the harvest progress on the main corn regions of the country impacts squarely on the forecast entry of trucks to Argentinian ports.

Besides, when analysing each port area separately, we can see important differences among them. Up River Paraná and Northern Buenos Aires ports show considerable decreases in the reception of corn trucks in comparison to last crop. This contrasts with the situation of Bahía Blanca and Necochea sea ports, which show a sharp increase in their entries of trucks loaded with yellow bean regarding last crop and the average.

To the uneven progress of threshing, we can add the effect of the low water level of the Paraná river, which conditions the waterway navigation and generates additional logistic costs that have been thoroughly analysed in this Weekly Report. In line with what was expected, the low level of the river has been the starting point to introduce a higher entry of trucks to the ports in the South of Buenos Aires, seeking to lessen the rise of logistic costs.

In this sense, a strong difference between the board price of corn in Rosario and Bahía Blanca can already be seen. While the month of July consolidates an average around US$ 193/t for the prices of the Cereal Arbitration Chamber of Rosario (CAC, for its Spanish acronym), on the Bahía Blanca Board the yellow bean has kept rising week after week and exceeded US$ 224/t. At the beginnings of this month, it was below US$ 200/t, but the low water level has had an effect pushing prices up for shipping in ports in the South of Buenos Aires. The local level of prices is still around 43% above last year’s, while the year-on-year increase in Bahía Blanca is over 54%.

On its part, soybean this week exceeded US$ 330/t, although with minor drops regarding last week, when it averaged US$ 333/t. Just as with corn, soybean prices keep showing a year-on-year rise near 38% in dollars.

As for foreign trade dynamics, the week closes with Export Sworn Statement (DJVE, for its Spanish acronym) of corn for over 0.8 Mt, below 0.91 Mt from last week but above the last few weeks, which had levels of sworn statements around 0.3 Mt per week. Corn DJVE, therefore, totalize 31.6 Mt in crop season 2020/21 to date, 16% above the levels of last crop season.

Regarding soybean complex, the week has had DJVE for about 0.88 Mt, below the 1.01 Mt from last week, although recovering a good of sworn statement dynamics with regards to past weeks, same as corn. Sworn statements of the soybean complex have reached an accumulated value of 21.2 Mt, 4% below last season as a whole. However, soybean by-products are 6% above last crop season, before drops of 27% and 3% in the DJVE of soybean and soybean oil.