The trading pace of soybean shows no delays regarding previous crops

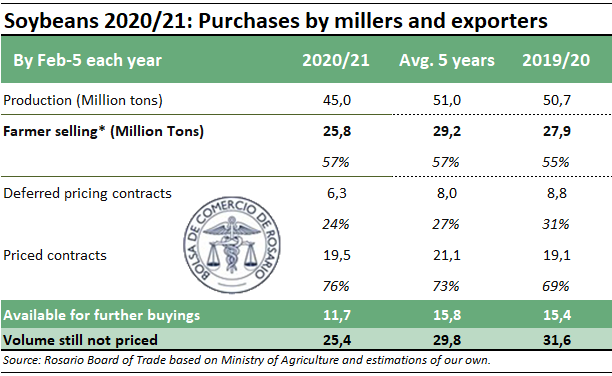

Once the euphoria of soybean harvest business has passed, which between the months of April and May left a balance of over 7 million tons traded, the purchase contracts in the month of June accumulated near 2.8 Mt and July is headed to totalizing 2.2 Mt, according to SIO Granos. To date, the 25.8 million tons that have been acquired so far by the export and oil industry represent 57% of the forecast production, in line with the average trade balance of the last 5 years and somewhat above the ratio registered by the same date last year.

To that, it must be added the 10% year-on-year production cut, according to estimations by the Rosario Board of Trade Agribusiness Strategy Guide (GEA, for its Spanish acronym), which leaves a balance of available soybean for sale from crop season 2020/21 of 11.7 million tons, far behind the availability of the last few years, which was around 15.5 million tons.

The local trade dynamics found soybean at around US$ 330/t this week, slightly below the average of US$ 335 from last week. With the foreign markets focus placed on the development of the crop in the US, the weekly report by the United States Department of Agriculture (USDA) confirmed the loss of conditions for the crop, which sets a lower cap and momentarily limits foreign drops, although the inflation in the US lights red flags about the evolution of global finances.

Excellent pace of purchase of corn

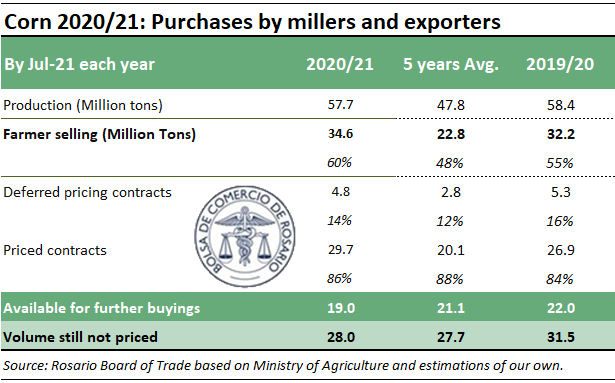

Harvesters keep moving forward on late corn in Argentina, although the 83% progress over the target area is still below the 94% registered by the same date last year, according to the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym).

Meanwhile, yellow bean trade has progressed at a historical pace, with almost 60% of the total supply already sold, 5 points above last crop and 12 points above the average of the last few years. To this high level of purchase we can add a more limited total supply, which leaves a lower grain availability than in previous crops, to an extent not seen since crop season 2015/16. On top of the good pace of sales of the current crop season, we can add trades for about 9% of the cereal’s upcoming crop season total supply, a ratio above the average 7% of the last five years. With the yellow bean around US$ 180-185/t in the local market, prices look stable for the upcoming crop season.

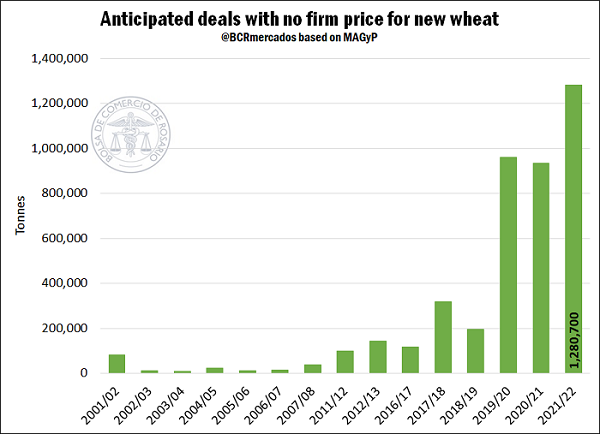

Record trade volume with wheat 2021/22 still unpriced

In a context of better prices and solid levels of demand, wheat trade for the next crop season progresses at record levels, exceeding 4 Mt. It is surprising, however, the high share of unpriced firm trades, which exceeds by 10 percentage points the average of the last few crop seasons. The evolution of markets during the upcoming months will be key for price setting. During July, wheat showed increases of around 5% of its dollar price for the domestic market, going from around US$ 200/t to near US$ 210/t.