New crop wheat sales set record for this moment of the year.

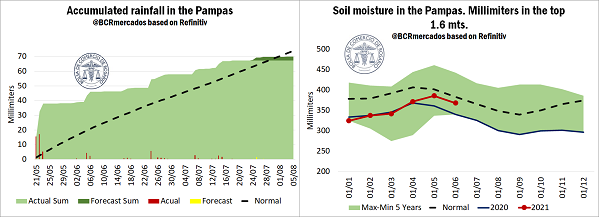

2021/22 wheat planting is virtually completed. By July 22nd, 96% of the area has already been planted, somewhat behind the figure reached last year by this time of the year but exceeding the average pace of the last five crops. The productive outlook raises some questions. Besides the follow-up carried out by Rosario Board of Trade Agribusiness Strategy Guide (GEA, for its Spanish acronym) on the core region, private reports indicate that the accumulated rains on the Pampa region during last month have been above the usual, so the moisture on the first 1.6 m of the soil is above the value registered by mid-year in 2020.

However, beyond those favourable initial conditions, there still is a long way to go and what happens with the climate during the following months will be decisive for the crop evolution.

On the last GEA-BCR report, the comments by our expert, Dr. José Luis Aiello, regarding the rains that can be expected for winter 2021 were analysed. The importance of counting with North-east circulation, which was the big factor missing on winter 2020, was pointed out. It literally read as follows: “During last Saturday (July 17), the entry of very cold air from the South to the central region provoked a sharp thermal drop and general frosts. The one on Monday 19 was the most intense. All provinces of the Pampa region were one or several degrees below zero.”

“But winter 2021 counts with a moderating influence: the alternation between South-west and North-east circulation. This change of direction interrupts the entry of cold dry air into the central region and facilitates the circulation of warmer air, with higher humidity content. This is very important, because it boosts the probability of rains. For this reason, the current scenario is very different from last year’s. In 2020, the prevailing circulation was purely from the South. This, added to the negative influence of “La Niña”, provoked a cold, more stable weather. By contrast, now the cold pulses are of short duration. This allows for the development of moderate rains, but close to normal, and is keeping an adequate availability of moisture for winter crops”, confirms Aiello.

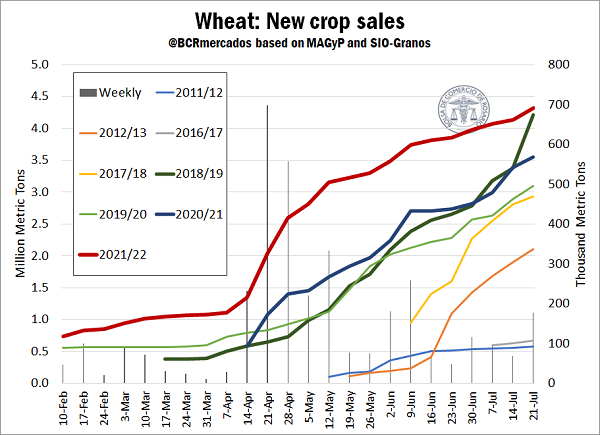

As for cereal trading, the pace of sales for 2021/22 wheat is the highest for a new crop by the same time of the year. To date, there have been sold 4.3 Mt of wheat, 22% more than the volume reached by mid-June, 2020, and exceeding the previous record of crop 2018/19. Anyway, as can be appreciated on the following chart, after the large volume of sales reached between mid-April and the end of May, the sales of the cereal slowed down.

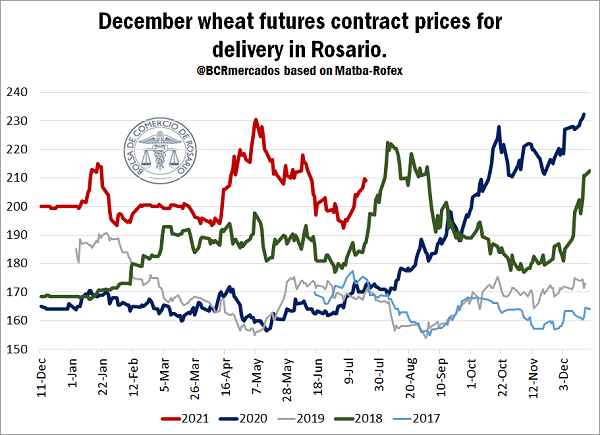

This slowdown in the trade of 2021/22 wheat is based, among other reasons, on the behaviour lately showed by prices. Taking the price of Matba-Rofex wheat futures to be delivered in December as a reference for harvest prices, that position showed a sharp increase since mid-April until the beginning of May, when it reached US$ 230.5/t on May 7. In that sense, although they later had a small drop, their values were kept relatively high until the end of May. However, during the month of June and until the beginnings of July, the price fell considerably, reaching US$ 192.5/t on July 6.

The evolution of prices might have worked as an incentive for producers, who made important sales when harvest prices peaked and reduced the volume traded when prices started to recede.

On the other hand, as can be appreciated on the chart above, since the incorporation in Matba-Rofex of wheat futures with delivery in December in Rosario, future for delivery in the last month of 2021 has been, considering all the previous futures for delivery in December, the one with a higher price ever. At present, the future is traded at US$ 209/t, 21% above the price reached a year ago and exceeding the 2018 record, when it was traded at US$ 187.5/t.

But also, if we extend the analysis backwards and take into reference December wheat futures with delivery in Buenos Aires, the current price of harvest wheat is the highest in history for the same moment of the year. Anyway, it should be pointed out that these contracts are not directly comparable, since the difference in the place of delivery implies various logistic costs for the delivery of goods, which results in a difference in quotes.

If we focus on wheat in the current 2020/21 crop season, the news this week come from milling data. As reported by the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), wheat milling during June reached 531,400 t, a 2% drop from May, and 4% with regards to the volume industrialized during the month of June 2020. Thus, since the beginning of the crop season to date, the accumulated value reaches 3.3 Mt, 8% below the vale accumulated during the first 7 months of the previous crop season, 2019/20. This slower pace has led to an adjustment in the wheat milling forecast for this crop season, which can be appreciated in detail on the last edition of the BCR Market Outlook Report.