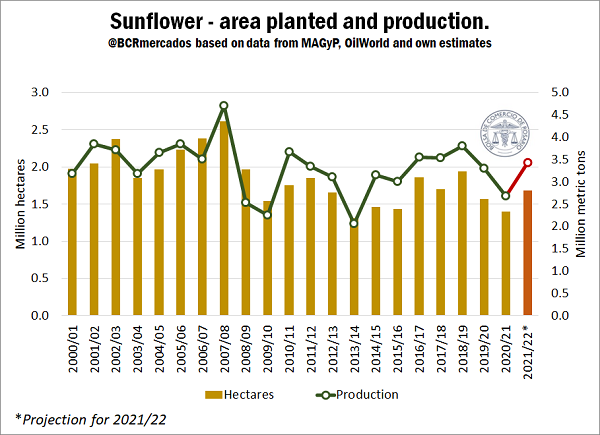

During the last few years, sunflower has remained one of the main grains produced in the country. Nevertheless, if we analyse the oilseed planted area through time, it can be appreciated that after reaching a relative record during crop season 2007/08, with 2.6 M ha planted (far below, however, the absolute planting record reached during crop season 1998/99 with 4.24 M h), from 2008/2009 on the covered area gave way and remained below 2 M ha.

In order to explain this decrease, it must be taken into account that between 2007 and 2015 the export duty tax rate for sunflower oil ranged between 30% and 37.2% (and 30% and 39% in the case of sunflower pellets/expeller). During the last crop season, unfavourable climatic factors were added, taking the planted area to a five-year minimum, with only 1.45 M ha covered. To this drop in absolute terms of the planted area we should add that, in line with the expansion of the agricultural frontier of the last few years, the oilseed’s share in the total planted area during the last year represented only 3.6%, far below the 7.6% reached during crop 2007/08.

As for the sunflower production, it has evolved through time along with the planted area, with a leap in yield from 2010/2011 with regards to what was observed in previous crops. With an absolute maximum in 1998/99 of 7.13 Mt and a historical minimum in 1974/75 of 732,000 tons, during the 21th century to date, sunflower production reached a cap of 4.7 Mt during crop season 2007/08, and showed a downwards trend from that point on. During current crop season 2020/21, the forecast production is 2.7 Mt, 43% below the figure obtained thirteen years ago.

However, the first forecasts for crop season 2021/22 shed a light of optimism. In the face of the remarkable price increase of the oilseed and its by-products during the last few months, incentives for the productive sector were improved, and the first forecasts of sunflower-destined area range from 1.65 to 1.80 M ha, meaning there would be an increase in the planted area of at least 16%. This way, considering the trend yield of the last decade, production for the new crop season might reach a floor of 3.4 Mt.

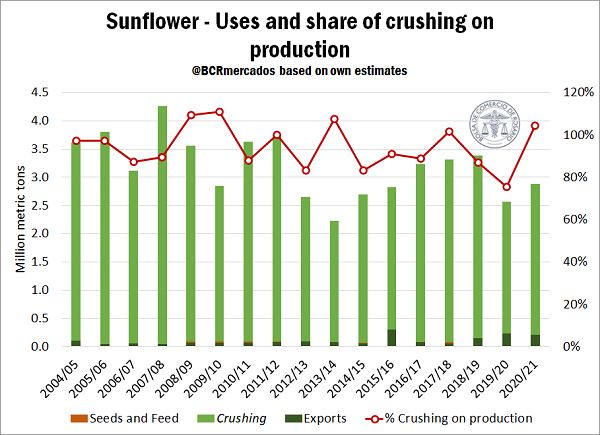

Regarding the uses of the oilseed, most of the crop is destined to the oil industry. On average, over 83% of the amount produced each year is destined to oil production, and the events in 2019/20 emerge as the only exception (during this crop season, industrialization represented 75% of the production obtained). Meanwhile, during the current crop season, it is forecast to industrialize 2.8 Mt of sunflower; that is to say, a volume even higher than the grain obtained. This is due to the fact that a high level of stocks remained available for processing during the current year because of the low volume industrialized during the previous crop.

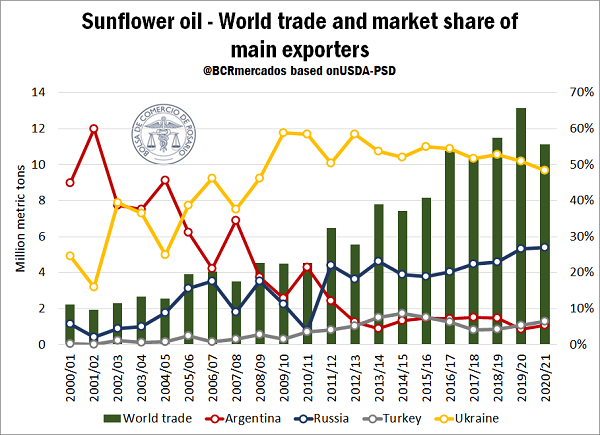

Argentina is a major player in the world market of sunflower oil, positioning itself as the 4th biggest producer and the 4th main exporter. Besides, for crop season 2020/21, its share in the world trade might be increased, representing 5.4% of total exports, above the 4.2% reached on crop season 2019/20.

However, if we analyse the evolution through the last few years, it can be appreciated the strong drop of Argentina’s importance since the beginnings of the new millennium to date. During crop season 2001/02, Argentina accounted for 60% of the world exports of sunflower oil, while Ukraine represented 25% and Russia, 6%. Then, sunflower seed production was similar in all three countries: 3.2 Mt in Argentina, 3.5 Mt in Ukraine and 3.7 Mt in Russia. The main difference was that, in our country, most of the grain produced was domestically industrialized to be then exported, while in those countries the grain was mainly exported unprocessed.

However, as years passed by, two phenomena occurred that led to this reduction in our country’s share of the world trade of sunflower oil and, at the same time, the increase in importance of Russia and Ukraine. On the one hand, there was a boom in the planted area of the oilseed (and therefore, in its production) on those countries of Eastern Europe: between crop season 2001/02 and 2020/21 it grew by 145% in Russia and 192% in Ukraine, while in our country the opposite took place, and the crop’s area receded by 24% between those years. On the other hand, the crushing capacity in both countries grew phenomenally. According to FAO, between 2006 and 2015, the installed capacity in Ukraine went from 6.3 Mt to 16.5 Mt per year, while in Russia, it increased from 6.5 Mt to 20 Mt per year.

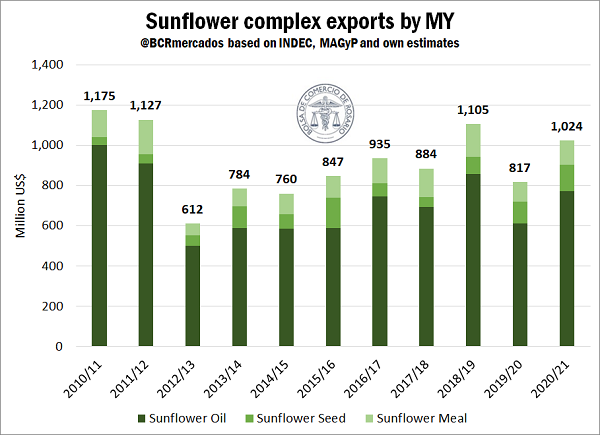

Beyond this reduction of relative importance at a world level of Argentina, the sunflower complex is one of the key export complexes of the Argentinian agribusiness sector and, therefore, an important generator of foreign currency. In fact, for the current year, sunflower seed, meal/pellets and oil exports are forecast to reach US$ 1,024 million, making it the 4th main complex of the agribusiness sector, only behind the three big: soybean, corn and wheat. Out of this total, most of it is accounted for by oil, reaching US$ 773 million, while seeds and meal/pellets would reach US$ 130 and US$ 121 million, respectively. Besides, this would represent a 25% increase from the value obtained in 2020.

This increase from the previous crop season is exclusively due to an improvement in the FOB prices obtained since, when analysing quantities, the tons forecast to be exported during the current crop season remain virtually identical to the ones shipped during the previous crop: 0.2 Mt of seeds, 0.59 Mt of meal/pellets and 0.56 Mt of oils.

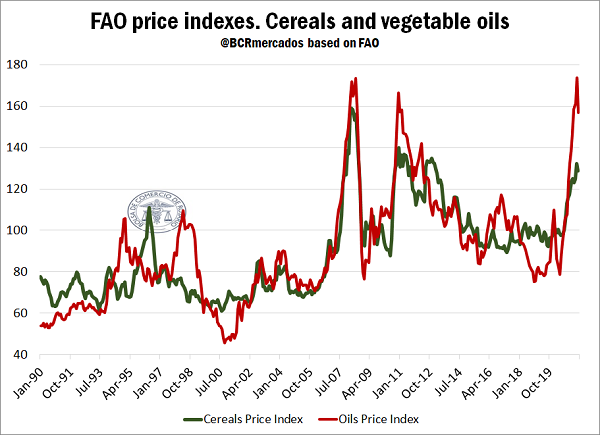

Since July last year, the prices of agribusiness commodities have experienced a phenomenal upward rally, and vegetable oils have been no exception. In fact, the price index of vegetable oils elaborated by FAO grew through twelve consecutive months between June 2020 and May 2021, and it reached on that month its higher record in history, surpassing the previous maximum from June 2008. Besides, as can be appreciated on the following graphic, the vegetable oils prices increase were even above those of cereals.

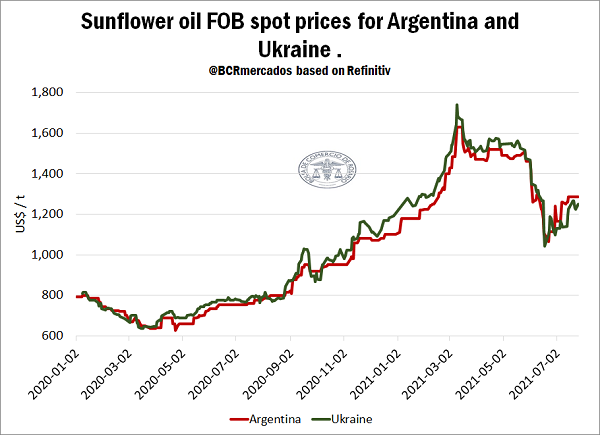

However, this trend was undone during the last month, and the index registered a sharp drop, hand in hand with the strong decrease of the prices of vegetable oils in world markets. Moreover, the price of sunflower oil was precisely one of the prices with the sharpest drops. Between June 1st and 22nd, FOB prices for nearby shipping both in Argentina and in Ukraine receded by 27%, although from that minimum reached, they showed an upward trend and recovered part of the lost ground.

The fall in the prices of sunflower oil is part of a strong price adjustment suffered by all commodities, especially agricultural ones, whose causes have been analysed in previous editions of this report.

However, there is a phenomenon specific to this oilseed that explains the strong decrease. Just as mentioned at the beginning of this article for Argentina, for the new crop season 2021/22 it is forecast a considerable increase of the planted area on a global level. Moreover, according to the specialized German consulting firm Oil World, the world is getting ready to reach an absolute record both in harvested area as in sunflower production on a global level, with 29.74 million hectares and 58 million tons, respectively. In this way, although the demand is forecast to keep high during the new crop season, the bigger supply limits the profits from sunflower oil prices.

Nonetheless, after this strong adjustment suffered by FOB prices, an upward trend can be noticed. This is due to a low global production of sunflower oil forecast for the July-September trimester. According to Oil World, sunflower crushing on a global level might drop by 13% compared to the same period of 2020. This is mainly caused by the fact that the first grains of the new crop on the Northern hemisphere would only start to enter the market in August, while the main part of the production is expected for the end of September, which has boosted prices, since the global demand is maintained while stocks start to decrease.

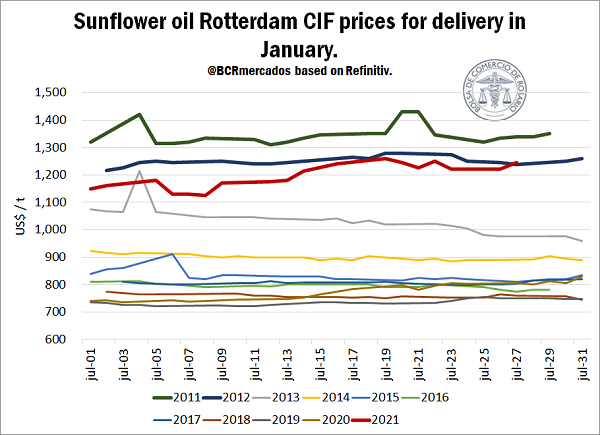

All the same, beyond the volatility shown, prices keep at historically high values. Taking as a reference the FOB price of sunflower oil for shipment in January, month that marks the official start of the new crop season, it is currently listed at US$ 1150/t, 54% above the prices offered a year ago.

Besides, a similar situation can be noticed by observing CIF prices of oil in Rotterdam, a reference market for quotes of vegetable oils on a global level. The price offered by this sunflower by-product to be delivered in January rises to US$ 1,240/t, while a year ago it was listed at US$ 800/t. Moreover, current prices for delivery on the first month of 2022 are the highest for the same moment of the year since 2011, when by the end of July of said year, the price of oil for delivery in January 2012 was US$ 1,340/t.

To sum up, although the Argentinian sunflower complex has lost relevance on a global level since the beginning of the new millennium to date, the outlook for the new crop season is promising and the optimism prevails within the sector. This has boosted a strong increase in planting intention, which let us glimpse a recovery of the production after the considerable drop during crop season 2020/21, as long as the weather remains favourable.