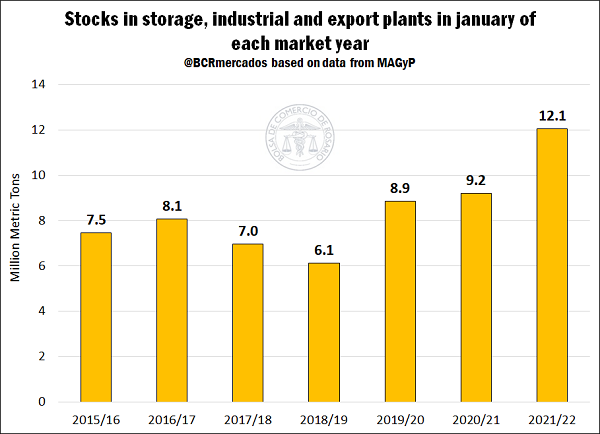

As the last days of December went by, the progress of the wheat harvest kept a good pace. According to the latest survey by the Argentinian Ministry of Agriculture, Livestock and Fisheries (MAGyP, for its Spanish acronym), threshing machines have already moved forward over 99% of the total 6.7 M ha. This record is just 2 percentage points higher than last year. At the same time, due to the good results in terms of yields, production is approaching historical record levels. This can be partially seen in the high volume of stocks in storage, industrial and export plants shown by data for January 2022, which with 12.1 Mt as of January 2022 is about 2.9 Mt above the record for last year. Furthermore, this volume exceeds the average of the last 5 years (7.8 Mt) by approximately 53.6%.

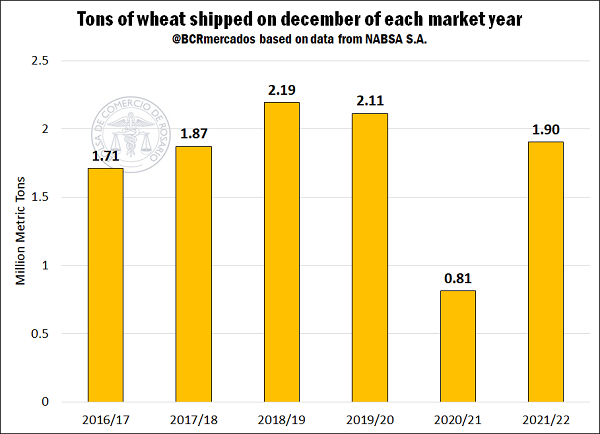

On the other hand, according to data by the shipping agency NABSA S.A., grain shipments in December totalled 1.9 Mt, exceeding the December 2020 record by 134%, partly due to union conflicts that affected shipments over that month and partly thanks to the productive recovery of the season in course. Thus, if we compare what happened in previous crops last month, it can be said that it exceeded 2016/17 and 2017/18, while it remained below the following two.

During last week and in the local market, wheat remained mostly constant in terms of active participants and open buying positions, although in terms of prices the trend was mainly downward. Yesterday, the supply of cereal for unloading in the available stretch of time was $ 24,000/t (local currency), below the US$ 240/t that were openly offered at the beginning of the previous week. For deliveries in February and March, offers by the export sector were around US$ 232/t and US$ 235/t, registering a decrease of US$ 6/t and US$ 5/t respectively for each position compared to the same day of the previous week. Then, and for the period between May and July, offers were generalized around US$ 237/t, resulting in a drop of US$ 5 in comparison to last week.

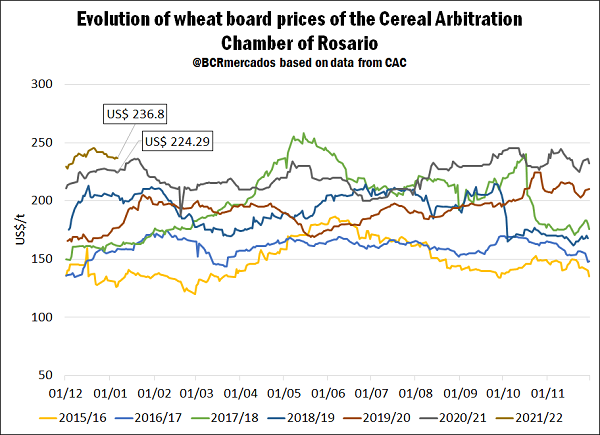

Regarding the evolution of the board prices granted by the Cereal Arbitration Chamber of Rosario (CAC, for its Spanish acronym) and in a year-on-year comparison, an increase of US$ 12.5/t is observed, that is, a 6% rise compared to the same moment of the previous year. In this way, if we consider the historical values since the 2012/13 crop season, the cereal is 8% behind the maximum registered in mid-May 2018 (US$ 258/t).